For those that invest with a value-based perspective, seeing the share price of a potential investment fall is typically thought of as an opportunity. This view aligns with the concept of mean reversion, which in investing, basically says that periods of underperformance are likely to be followed by periods of outperformance and strong returns are likely to be followed by weaker ones. Under this premise, the best time to invest is during the bad times, as good times will eventually return.

However, it is important to note that this concept is generally more applicable to broader markets rather than individual stocks. In short, buying when there is “blood in the streets” is not always a winning strategy.

When looking for new investment opportunities, some investors look to the list of stocks reaching new lows, under the belief that stocks that have fallen from their highs have the potential to return to their historic levels. It is important to remember that just because a stock previously traded at a higher level there is no guarantee that it will do so again. It can work, but there may also be a reason why the market has re-priced the stock.

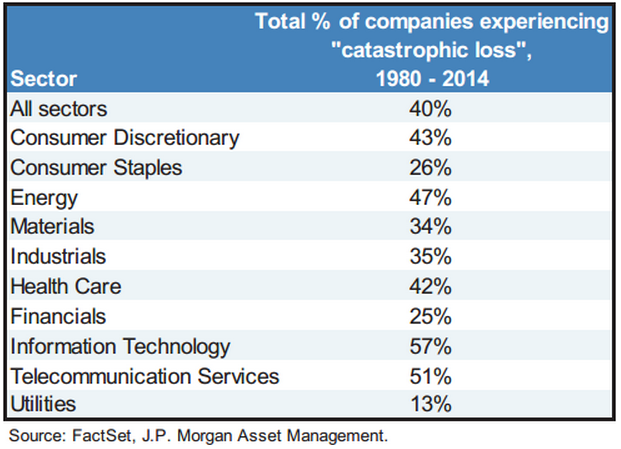

JP Morgan Asset Management conducted research on share price performance using a universe of Russell 3000 companies (the 3,000 largest U.S. companies by market capitalization) since 1980. It found that roughly 40% of all stocks have suffered a permanent 70% or greater decline from their peak levels. As depicted in the table below, this trend is most common in the information technology sector, as nearly 60% of technology companies have had a catastrophic loss (defined as “a 70% decline from peak value with minimal recovery”).

Such occurrences are likely most prevalent during periods when, in retrospect, the market reached “bubble” territory. For example, on June 26, 2000, memory chip manufacturer Rambus Inc. closed at an all-time high of $117.35. The shares fell more than 70% from this level during 2001. They never recovered from this “catastrophic” loss. In 2014, they have traded between $8.44 and $14.69.

Similarly, before the 2008 financial crisis shares of Citigroup reached a split-adjusted, all-time closing high of $564.10 (on 12/27/2006). During 2008, the shares were 70% below this level. In 2014, they have traded between $45.60 and $56.20.

When a stock falls in price, there is often a reason for the decline. Increasing the allocation to a declining stock or establishing a new position in shares that have tumbled from their highs can be a good strategy, but it can also backfire. It is important to understand the cause of the price drop and to assess the prospects for the company’s business going forward. It is also important to recognize that stocks can trade well above their intrinsic values as the market moves higher and investor sentiment rises for prolonged periods of time. Our value-based investment approach and process is meant to help us identify stocks trading below their intrinsic values that have the potential to deliver solid long-term gains. The type of fundamental analysis on investments described in last week’s commentary on Tupperware is used to help us identify such securities.