ESG INVESTING

What is ESG?

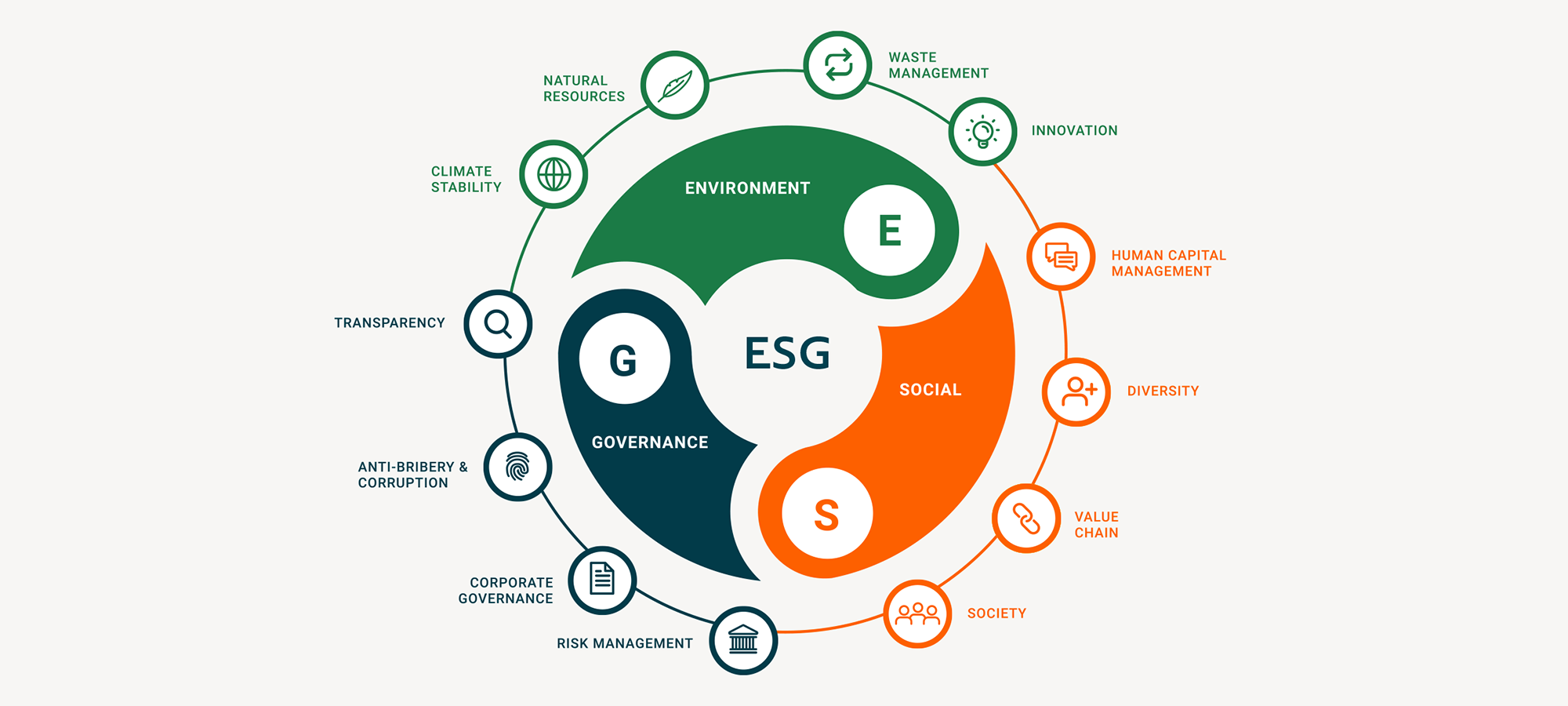

Environmental, Social, and Governance factors that are used by investors and shareholders as criteria to assess a company’s values and impact on the world. These points of analysis, alongside financial considerations, can help investors gauge the risk of a company based on their ESG practices. The environmental aspect of ESG refers to how eco-friendly a company is based on a company’s energy use, fuel/waste management, ecological impacts, and more. Socially, ESG deals with a company’s labor law and safety, their business relationships, and their exposure to certain social impacts. Governance associates with the structure of a company, their management efficacy, and the creation and enforcement of their policies. A strong ESG profile may better equip a company to be prepared for future challenges.

Today, more and more firms and investors are turning to ESG approaches as these factors grow in relevance. At BWFA, we are constantly striving to implement ESG strategies into our work.

What are the advantages of ESG?

As ESG investing grows in popularity, investors may use ESG criteria alongside financial factors as a lens through which they analyze companies’ performances. There are several advantages to ESG consideration:

- To have your portfolio reflect the values that you hold without sacrificing returns

- To promote sustainability and other positive environmental/social benefits while receiving a financial return on these investments

- To create a culture of decision-making that accounts for the future and societal welfare (to hold corporations accountable for the choices they make)

- To incorporate diverse options, including foreign and domestic

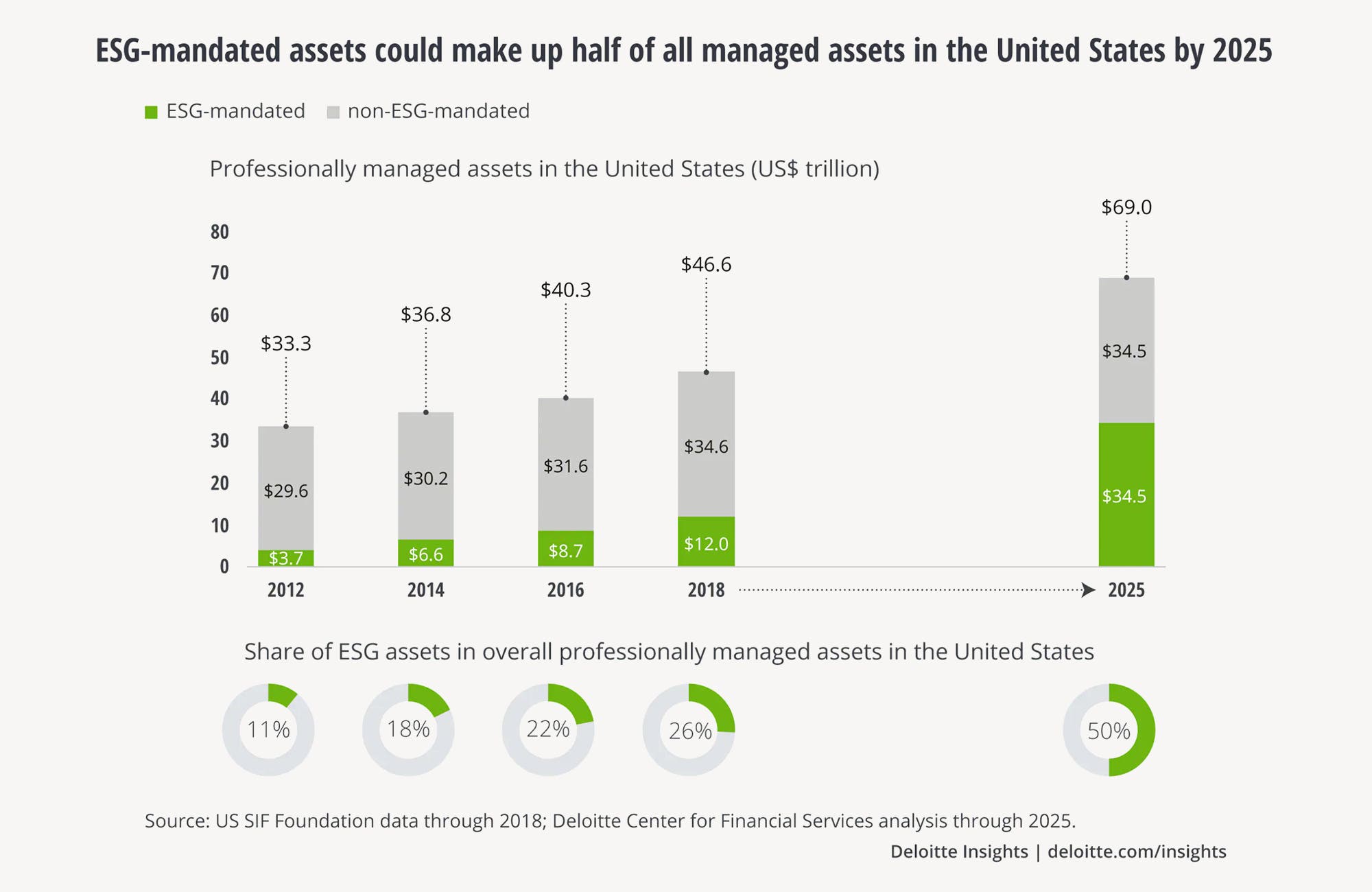

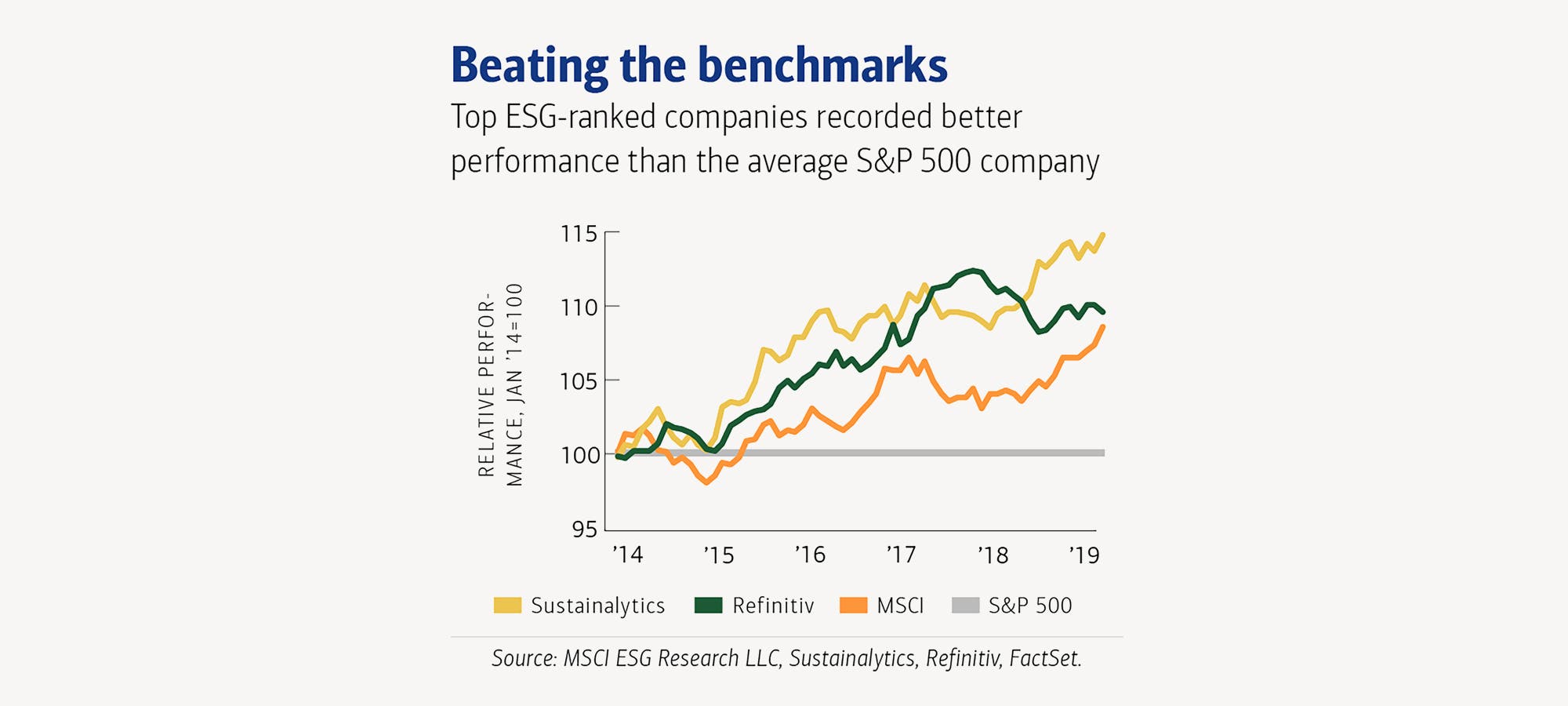

Research shows that solid corporate sustainability performance results in better financial results and that stock price is positively influenced by these sustainable decisions. From both a business and a marketability standpoint, sustainable companies have the edge.

Our Mission

BWFA views ESG considerations as a business fundamental for the long-term success of our company and continues to have conversations about improvement in these areas. Positive ESG practices facilitate sustainable and responsible investing, which allows us to remain forward-thinkers as we work closely to improve internally on ESG factors.

At BWFA, we are committed to delivering value to our clients. To do so requires financial and communicative transparency, effective risk management systems, and investment into the development and wellbeing of all of our employees. This, along with forming community relationships and creating a diverse environment, will foster growth and innovation for our company and our clients.

Our sustainable strategies

![]()

ENVIRONMENTAL:

- We are committed to reducing our carbon footprint and managing our waste.

- We continue to strive to understand the environmental effects of our financing activities and use our findings to improve for the future.

- We encourage our clients to support companies that are making a positive impact on the environment and society.

![]()

SOCIAL:

- We focus on establishing close personal relationships between our clients and an experienced fiduciary advisor.

- We provide a comprehensive range of accessible financial services.

- We offer frequent education workshops and seminars to aid you in your financial and retirement planning.

- We are active participants in our community, supporting many local organizations. For information, please visit our In the Community page.

![]()

GOVERNANCE:

- We practice a very disciplined investment process to promote financial security.

- We ensure that BWFA has the knowledge and skills to manage sustainability risks.

Call us today at 410-461-3900 or emailus@bwfa.com to learn more about our ESG capabilities.